Price Action Trading: Mastering the Art of Forex Charts

Price action trading is one of the most popular methods among Forex traders. It involves analyzing historical price movements to predict future market behavior without relying heavily on indicators. By focusing on raw price data, traders can develop a more intuitive understanding of market trends and make more informed trading decisions. When using best forex trading platforms, price action trading can be particularly effective due to the advanced charting tools and real-time data available to traders.

What is Price Action Trading?

Price action trading revolves around the idea that price reflects all necessary information, including market sentiment, economic data, and news events. Instead of relying on technical indicators or lagging data, price action traders read and interpret price charts to make trading decisions. By analyzing trends, support and resistance levels, and price patterns, traders aim to predict the future direction of the market.

Key Components of Price Action Trading

Trend Analysis

The first step in price action trading is identifying the trend. The direction of the market—whether it's an uptrend, downtrend, or ranging market—will influence trading decisions. In an uptrend, traders look for buy opportunities, while in a downtrend, they focus on sell signals. When the market is ranging, traders often use support and resistance levels to find potential entry points.

Support and Resistance Levels

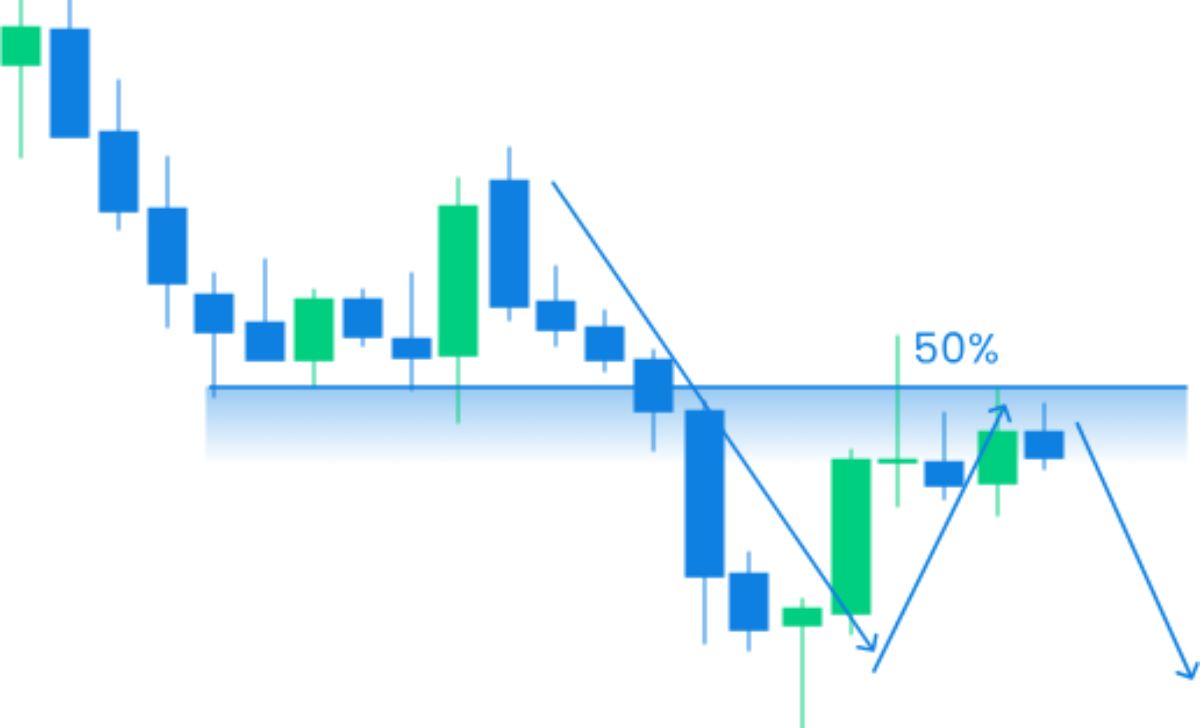

Support and resistance are key concepts in price action trading. These levels act as psychological barriers where price tends to reverse or stall. Support is the level where the price tends to find buying interest, while resistance is where selling pressure emerges. Traders use best forex trading platforms to draw horizontal lines at these levels, watching closely for price breakouts or reversals.

Candlestick Patterns

Candlestick patterns are an essential part of price action analysis. Specific formations, such as doji, engulfing, or pin bars, can signal potential reversals or continuation in the market. Learning how to interpret these patterns helps traders gauge market sentiment and make more precise trade entries.

Chart Patterns

Chart patterns such as triangles, head and shoulders, and double tops/bottoms are other tools used in price action trading. These patterns often indicate significant price moves when they complete. Traders look for breakouts or breakdowns from these patterns to enter trades with high potential for profit.

Read more: How to Use Fibonacci Retracements in Forex Trading

Why Choose Price Action Trading?

Price action trading offers several advantages over other strategies. One of the biggest benefits is its simplicity. Since traders focus solely on price movements, they do not have to rely on complex indicators or external data, making it a more straightforward approach. Moreover, price action trading can be used in any market condition, whether the market is trending or moving sideways. It can also be applied to any timeframe, making it versatile for different trading styles.

How to Implement Price Action Trading

To implement price action trading effectively, start by practicing on demo accounts provided by the best forex trading platforms. This allows you to hone your skills without risking real capital. Begin by focusing on trend analysis, support and resistance levels, and basic candlestick patterns. As you gain experience, you can incorporate more complex chart patterns and refine your strategy.

Read more: Top Technical Indicators in Forex Trading

Combining Price Action with Other Tools

While price action can be highly effective on its own, it often works best when combined with other tools, such as volume analysis or market sentiment indicators. For example, using price action in conjunction with volume can help confirm the strength of a trend. Additionally, keeping an eye on news events and economic data can provide context for price movements, further enhancing your analysis.

Price action trading is a powerful and intuitive way to approach the Forex market. By learning how to read and interpret price charts, traders can develop a deeper understanding of market dynamics and improve their decision-making skills. Using best forex trading platforms makes the process even more efficient by offering advanced charting tools, real-time data, and a user-friendly interface.

Whether you're new to Forex or an experienced trader, mastering the art of price action trading can help you gain a competitive edge in the market. With practice and patience, you can use price action to make informed, confident trading decisions that align with the market's true movements.